When it comes to investing, one of the most critical things to understand is that there is no “one right path” to follow for success. Everybody’s goals differ from the next person – meaning that the strategy they develop to accomplish them can vary wildly, too. Only by carefully considering what it is that you want from investing will you be able to put together the realistic, actionable steps you need to take to get there.

Thankfully, this process isn’t nearly as difficult as new investors tend to assume. It does require you to capitalize on a few key pieces of advice along the way.

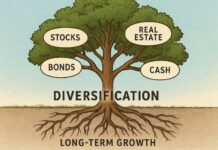

The Importance of Asset Allocation

When many people new to investing hear the term, they usually call to mind one of two things: real estate or the stock market. In reality, there are a wide range of asset classes to take advantage of, and asset allocation allows you to do precisely that.

This is the act of dividing your investments not only among different investments but different asset types – from stocks to bonds to cash and beyond. Some of your money might be in bonds for long-term security, while some may be in wholesale real estate for short-term flexibility.

The significant benefit is that this helps mitigate risk as much as possible. If all your money is in the stock market, you’re at the mercy of the market itself. One particularly bad day or period (which has been known to happen) could wipe out a significant amount of your wealth. But if you also have bonds or wholesale real estate, you’re less exposed to any single point of failure.

Different investment types also have unique advantages depending on what you’re trying to accomplish. For example, securities would be a great long-term way to help pay for things like retirement or your children’s education.

The Key to Investing Wisely Involves Paying Attention to Individual Opportunities

Along the same lines, you also want to take care to select your investments wisely. Never act on “gut instinct” or “intuition” when you have cold, hard data to draw from.

Begin by taking a look at the overall financial performance of the asset. If you’re planning on investing in a piece of real estate that will be used as a rental property, for example, it stands to reason that you would want to know whether that property is currently losing money. If it is making a profit, you should know how much so that you can anticipate what your return will be over time. If it’s losing money, find out why. Is it due to factors you can address or things beyond your control? These are crucial questions to answer.

You also need to consider the growth potential and the investment time to achieve that status. The growth potential needs to be big enough to be worth your effort. You also need to ensure the growth period aligns with your goals. If you plan on retiring in five years, an investment that will take decades to yield a 3% return doesn’t make sense, given your goals.

Lastly, you’ll want to analyze market trends to see what you can glean about where your investment might be headed. If you have your heart set on investing in real estate, but current market trends indicate that we’re about to hit a period where things decline, you might consider putting your money elsewhere for the time being.

Regardless, market trends can help confirm that you’re getting into an investment while it is still on the rise, as opposed to one that has already peaked and is about to begin its cool-off period.

Continuous Success Requires Continuous Improvement

Finally, you must acknowledge that the market conditions will always change around you. This is their nature. Therefore, today’s “sure bet” may become tomorrow’s “loser” right before your eyes. Likewise, your goals will likely change over time. As you accomplish certain objectives, they fall off the list to be replaced by others. As you age, you re-think certain things and realize that you no longer want some of the things you set out to achieve in the first place.

All this is to say that you must constantly monitor your portfolio’s performance and rebalance it. This can help you adapt to changing market conditions and ensure that your portfolio remains aligned with your long-term objectives. Building an investment strategy is not something you “do once and forget about.” If your portfolio still looks the same ten years from now as it does today, you’re likely doing it wrong.

By prioritizing these three key strategies, you’ll have the tools to build a well-structured and successful investment portfolio. Not only will it allow you to see short-term gains, but it will continue to carry you towards your ultimate objectives for years to come.